Case Study

KYB

Predicate Identity

Token Sale

KYC

AML

Privacy

Powering One of 2025’s Largest Token Sales With High-Performance Onchain KYC & KYB

Aztec Network – the leading privacy-first blockchain – launched a fair-access, fully onchain token sale in November 2025 that attracted global participation. More than $60 million in bids flowed in within the first month, with users spanning 191 countries.

In order to meet regulatory requirements for the token sale, Aztec partnered with Predicate to orchestrate identity and wallet risk screening and enforce approval onchain.

The outcome: A fast, frictionless KYC and KYB experience at global scale, with industry-leading conversion rates and robust risk controls that protected both Aztec and its users.

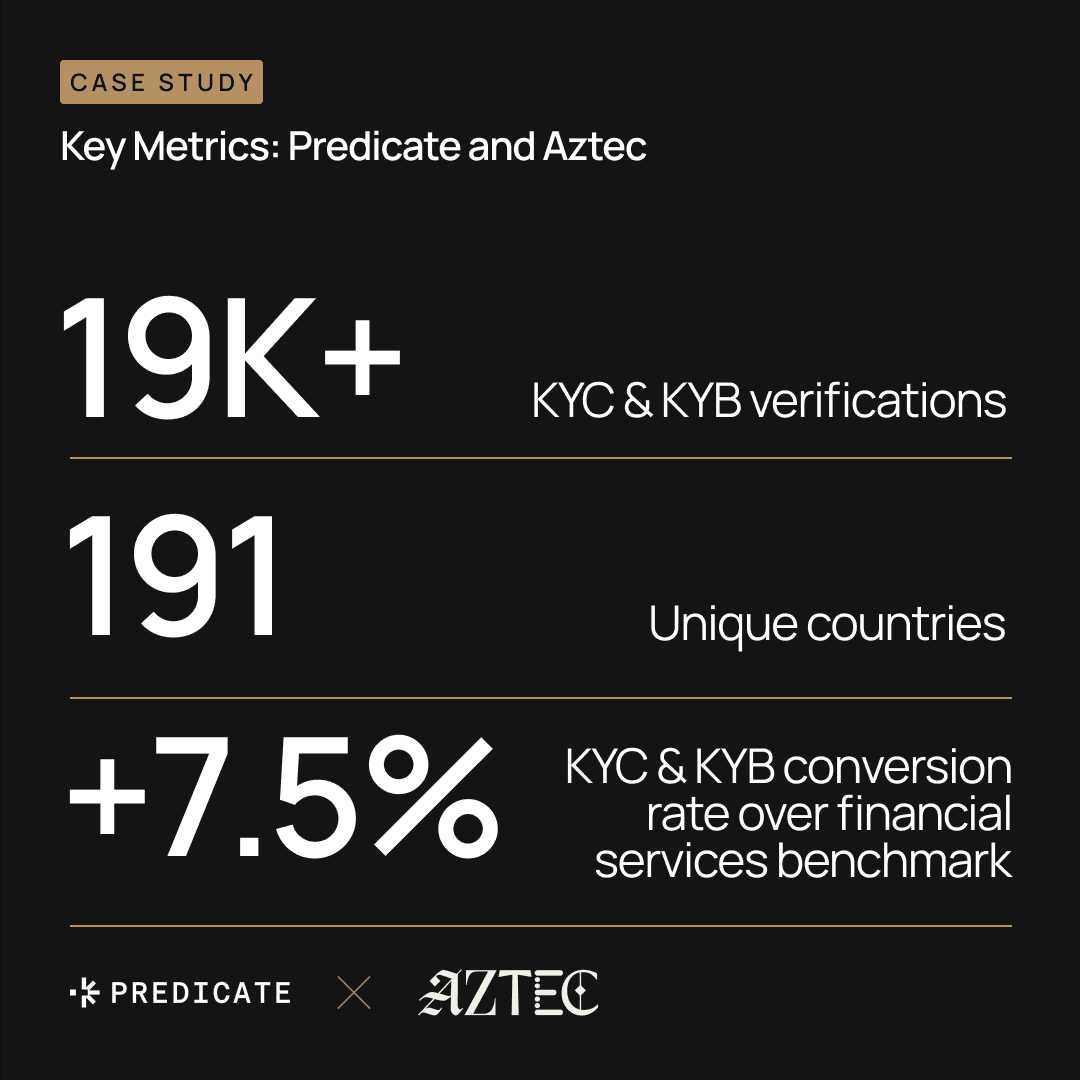

18,941 retail users and 146 financial institutions verified

Users verified in 191 unique countries

82.2% KYC & KYB approval rate, with only 8.3% of users requiring manual review.

44.5% KYC process completion rate, out-performing the financial services industry benchmark of 37.0%.

Sub-second latency on KYC status update to onchain enforcement

Keep reading to learn how Predicate enabled performant, compliant identity screening aligned with Aztec’s mission of privacy and decentralization.

Background information: Aztec Network

Aztec Network is an Ethereum Layer 2 (L2) blockchain designed for privacy. Aztec utilizes zero-knowledge (ZK) technology to keep all transaction data private, enabling users to trade, make payments, and earn yield without revealing their financial information to the world.

“At Aztec, we believe privacy is a right, not a feature. For everyday users, it means the freedom to transact without broadcasting their financial lives to the world. For institutions, it’s a prerequisite for participation at scale, enabling compliance, confidentiality, and risk management without sacrificing the benefits of open blockchains,” said Joe Andrews, President and Cofounder of Aztec Labs.

Decentralization is also a core Aztec value. Aztec Network is one of the first L2s to reach the final stage of Vitalik Buterin’s L2 trustlessness framework, meaning the blockchain is completely governed by transparent code rather than a centralized entity.

Aztec’s commitment to decentralization was crucial when it came time for the network’s highly-anticipated token sale. $AZTEC holders stake their tokens to secure the blockchain and are responsible for network governance, so it was imperative that the token sale be carried out onchain, with transparency and fair access, to explicitly ensure no capture by centralized token launch platforms.

The compliance challenge: Balancing KYC & KYB requirements with privacy in a decentralized, fair-access token sale

The other requirement for Aztec’s token sale: Compliance. As a regulated entity, Aztec needed to verify the identity of all token sale participants – both individuals and institutions – and screen for sanctions status, residency restrictions, and onchain exposure to illicit activity.

The process also needed to be efficient. Crypto users have famously low patience for clunky or slow onchain identity verification processes, so Aztec needed strong UX throughout the verification process to maximize participation and uphold its brand.

Aztec’s unique combination of business and regulatory requirements made screening for the token sale complex. How could the team run a strong compliance program while also preserving decentralization, auction transparency, and seamless UX? By using Predicate Identity to enforce KYC & KYB screening onchain.

The solution: Onchain KYC & KYB with Predicate Identity

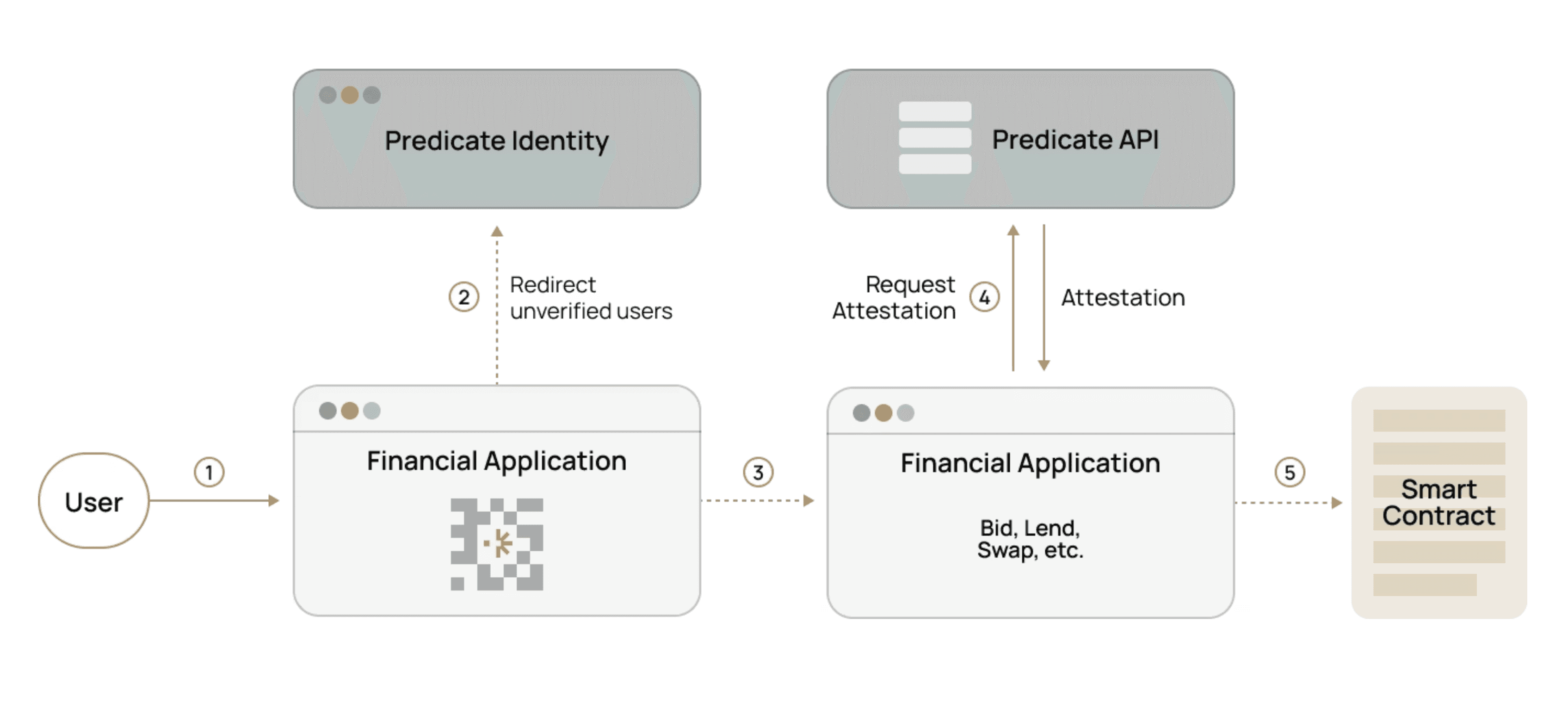

Predicate Identity is a KYC & KYB tool used for onchain identity verification and customer due diligence. It acts as both a front-end interface and onchain enforcement mechanism for identity verification.

Predicate Identity provides a unified flow for users to verify their identity and wallet risk, and then enforces policies based on identity approval status onchain via smart contract integration. In the context of a token sale like Aztec’s, this means gating access to the token sale at the smart contract level, based on the KYC & KYB status associated with each participating wallet.

Predicate Identity has several unique architectural advantages for this use case:

Predicate stores no personal data. All identity checks are handled by integrated offchain providers.

Predicate allows teams to create programmable policies – custom rules for which wallets are allowed to interact with the token sale based on KYC & KYB results, in conjunction with other factors like onchain risk scoring.

Predicate enforces rules at the smart contract level, making them impossible to bypass, unlike application UI-level restrictions.

Predicate can integrate multiple verification providers under one policy and UI, and enforce verification results seamlessly.

Predicate makes KYC & KYB status instantly enforceable via real-time onchain attestations.

Token sale KYC & KYB: Breaking down Aztec’s Predicate Identity policy

Aztec’s KYC & KYB process needed to confirm users’ identity, check their sanctions status and jurisdiction, and screen their wallets for onchain risk before they could be approved to participate in the $AZTEC token sale. The Predicate team worked with Aztec to accomplish that with a sophisticated KYC & KYB process managed through Predicate Identity, with all supporting providers integrated into one seamless identity verification experience:

Identity verification. Users connected their wallet on the token sale site and were directed to provide KYC & KYB documents (passport, driver’s license, certificate of incorporation, etc.) to Sumsub, an industry-leading identity verification service, via the Predicate Identity UI. Sumsub confirmed each user as meeting the Aztec Foundation’s regulatory requirements, and then relayed each wallet’s approval status to the Predicate API. When necessary, Predicate carried out manual identity reviews as well.

Onchain risk scoring. Aztec also needed to confirm that every token sale participant’s wallet was clear of onchain illicit activity risk. In order to accomplish this, Predicate integrated with blockchain analytics firm TRM Labs, which provided each wallet’s onchain risk score, flagging those with exposure to activity like fraud and crypto exploits.

The Predicate platform aggregated the results of both compliance checks and confirmed them onchain for each participant wallet, only allowing those that passed both to bid for $AZTEC.

Aztec also provided an alternate process for retail users in some countries to confirm their identity via the ZKPassport verification tool. ZKPassport scans an NFC chip in users’ passports to confirm their identity and sanctions status without collecting identifying information, using ZK verification technology. Predicate carried out the wallet risk scoring check via the TRM integration for users who passed ZKPassport identity verification, allowing Aztec to offer some participants an alternative, cryptographically-enhanced identity verification process with no drop in compliance effectiveness.

The results: Over 18,000 users in 191 countries screened at industry-beating KYC & KYB conversion rates

Aztec’s token sale was one of 2025’s biggest, and one of the biggest ever for a privacy project. As of December 14, 2025, participants have bid nearly $60 million in ETH to purchase $AZTEC, under a month after the sale’s private round went live.

Predicate Identity helped facilitate that success by efficiently orchestrating KYC & KYB for over 18,000 token sale participant wallets. More specifically:

18,941 retail users used Predicate Identity for KYC

146 financial institutions used Predicate Identity for KYB

Predicate Identity verified users in 191 unique countries

82.2% KYC & KYB approval rate, with only 8.3% of users requiring manual review.

44.5% KYC process completion rate with Predicate Identity, versus the overall financial services industry benchmark of 37.0%.

Sub-second latency on KYC status update to onchain enforcement

Predicate Identity’s KYC & KYB process filtered out over 250 high-risk users, most of whom were rejected for submitting false documents or for residing in a high-risk jurisdiction.

Predicate proved that global-scale token distribution can be run onchain without compromising compliance, UX, or decentralization – all of which enabled Aztec to exceed its token sale goals.

“Predicate made it possible for us to run a truly global, onchain token sale without compromising on compliance, user experience, or decentralization. Its KYC & KYB process caught hundreds of high-risk applicants while keeping the flow seamless for real users,” said Joe Andrews.