Case Study

Compliance

AML

defi

Vaults

RWAs

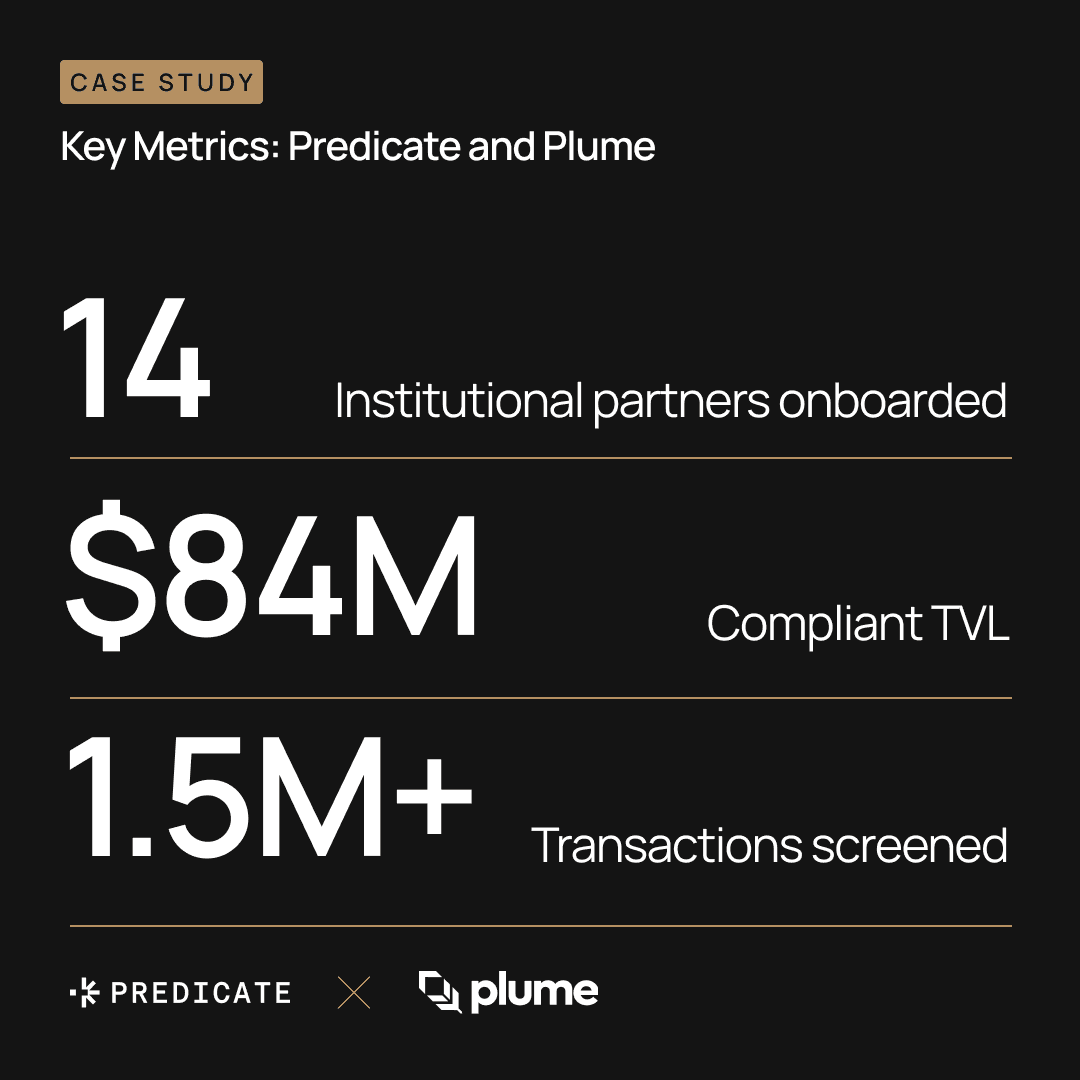

Programmable Compliance Empowers Plume to Onboard 14 Institutional Issuers, $84M in TVL to RWA Yield Platform

Plume is the first blockchain purpose-built for RWAs, and the largest by unique RWA holders. Plume is not only bringing RWAs onchain, but building a DeFi ecosystem for users to put those assets to work. Nest is a perfect example: Built by the Plume team, Nest is an RWA yield protocol where users stake stablecoins in Nest vaults to earn yield from tokenized institutional assets.

The catch: Institutional-grade assets require institutional-grade compliance. TradFi giants like WisdomTree and Apollo need robust anti-money laundering (AML) screening to confirm bad actors aren’t accessing their products onchain, just as they’re required to do in a traditional offchain environment.

That’s where Predicate comes in. Predicate teamed up with Plume to implement real-time AML screening on all Nest vault depositors, ensuring that Plume’s institutional partners can meet their compliance requirements – without added friction for users.

The results:

14 institutional partners with 198 assets deployed on Nest, with more issuers onboarding now

$84 million all-time high in compliant TVL on Nest

Over 1.5 million Nest transactions screened by Predicate

Keep reading to learn how Predicate enables Plume to run an RWAfi platform with institutional-grade compliance.

Background information: Plume and Nest

What is Plume?

Plume is the first chain dedicated to RWAs. Since its mainnet launch in June 2025, the network has grown to all-time highs of $300 million in TVL, and hosts over 280,000 unique RWA holders – the most of any chain and more than double the next-largest network (Ethereum).

Plume achieves all of this with an EVM-compatible, composable environment designed to integrate RWAs with DeFi protocols that maximize those assets’ onchain utility.

What is Nest?

Nest is the RWA yield protocol built by Plume that allows users to stake stablecoins and earn from the return generated by RWAs issued by Nest’s institutional partners. Assets on Nest include tokenized funds from WisdomTree, Apollo, Hamilton Lane, and more, as well as U.S. Treasury Bills and commodity-backed instruments. Nest is the perfect example of Plume’s vision to integrate the worlds of TradFi and DeFi, allowing users to earn real-world institutional yield onchain.

The compliance challenge: AML and sanctions screening

As Plume onboarded financial institutions to Nest, compliance teams repeatedly asked: How can we conduct AML and sanctions screening on all vault depositors? Financial institutions have a regulatory obligation to ensure that they aren’t taking money from sanctioned actors or individuals associated with criminal activity. Those rules apply whether investors are buying onchain or through legacy platforms. Nest needed a tool to screen vault depositors for high-risk activity, while still maintaining a seamless user experience and smooth front-end interface.

"We needed a DeFi-compatible approach to AML/CFT/Sanctions screening and the Predicate team had an off the shelf solution," said Plume General Counsel Salman Banei.

Blockchain monitoring tools have the wallet risk data Nest needed for screening, but no means of using that data to screen and filter out non-compliant deposits in real time. Additionally, traditional sanctions screening tools run on static lists of sanctioned addresses, which need to be updated manually, creating unacceptable risk of false negatives.

The solution: Real-time AML screening with Predicate programmable policy

Predicate was the perfect solution for Plume’s problem. Predicate’s programmable policy platform allows onchain application teams to set custom compliance rules that are integrated at the smart contract level and enforced in real time, using both onchain (e.g. wallet risk scoring and transaction history) and offchain data (e.g. internal whitelists and KYC information) to screen every transaction.

We kicked off our work with Plume by helping the team build a policy tailored to their RWA use case and institutional partners’ unique needs, utilizing our knowledge of regulations in Plume’s key jurisdiction and connecting the team with outside legal and compliance experts. That allowed Plume to craft an AML screening policy powered by two key data sources:

Plume’s internal whitelists

TRM Labs’ onchain risk scoring to flag wallets associated with criminal activity (drugs, terrorism financing, human trafficking, etc.)

We also helped Plume select backup data providers so that policies can continue running in the event that one of their preferred providers goes down temporarily.

Here’s how Nest’s AML screening policy works with Predicate implemented:

Users initiate deposit transactions into Nest vaults at the smart contract layer.

The Predicate API checks each depositor address against a dynamic blacklist powered by TRM’s high-risk wallet data (or Predicate’s dynamic OFAC sanctions list as a backup).

Transactions flagged as high-risk fail the check and are automatically rejected.

Compliant transactions proceed smoothly

Predicate’s sub-second latency ensures that compliant transactions proceed uninterrupted, maintaining a seamless user experience for Nest depositors.

The results: Nest continues to grow and onboard institutional asset issuers

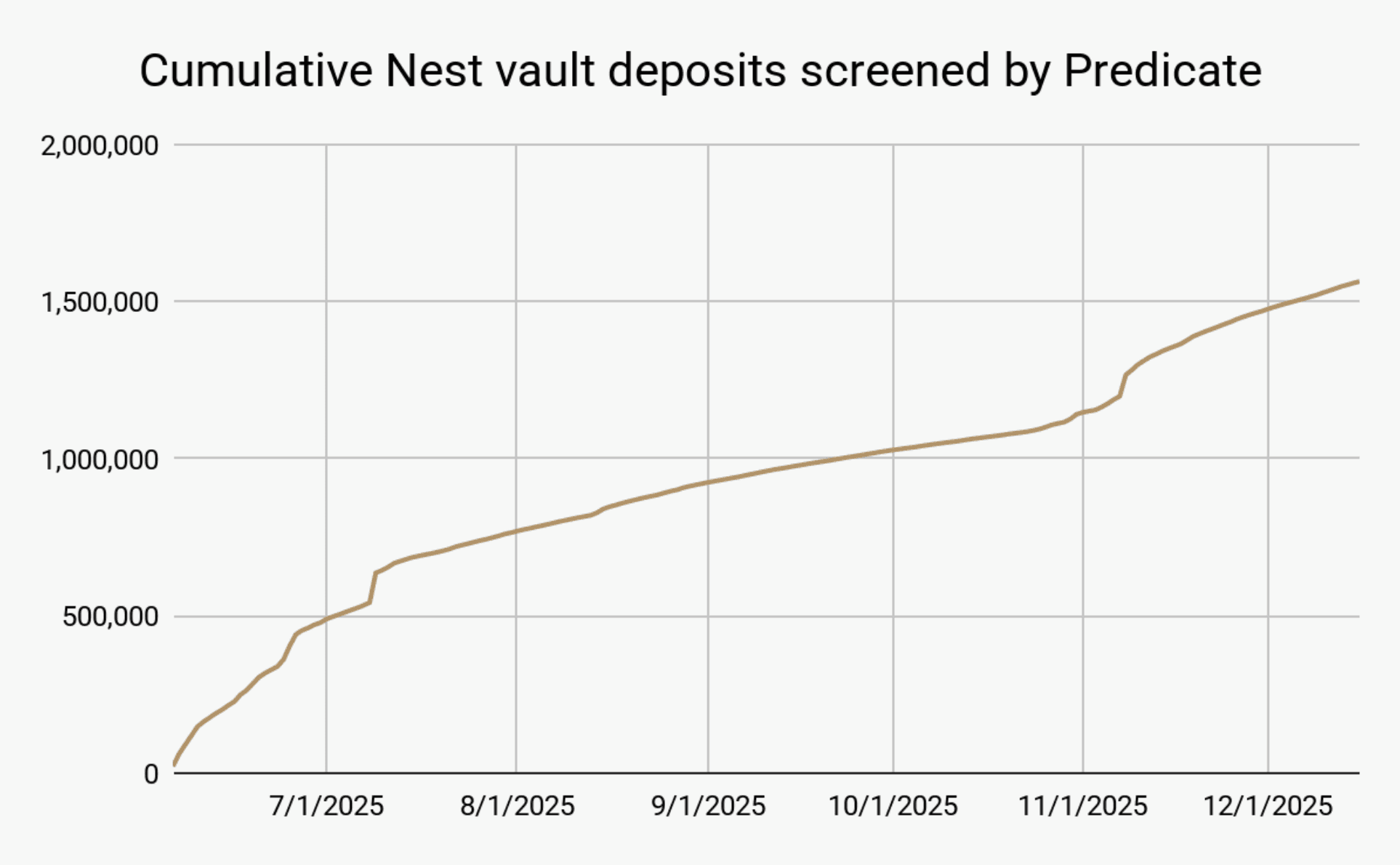

Plume’s integration of Predicate’s real-time screening allows financial institutions to deploy assets on Nest confidently, knowing they have the same level of AML protection that they have offchain. So far, 14 unique financial institutions have issued assets in Nest vaults, with more expected soon. Those assets have attracted as much as $84 million in TVL on Nest. Overall, Predicate has screened more than 1.5 million deposits to Nest in real time – with an all-time daily high of over 68,000 transactions.

Those numbers will continue to rise as Nest onboards more institutions and users. Predicate’s multichain capabilities are also enabling Plume to expand Nest to new environments like Solana, BNB Chain, and Plasma, with the same level of compliance enforcement it gets on the Plume chain.

"App and smart contract level compliance could have been a huge operational burden for us, but Predicate simplified it so that we could focus on the product and scaling it across every ecosystem seamlessly. The results speak for themselves,” said Plume Head of Regulatory Product Strategy Alex Palmer.

DeFi vaults are evolving from "degen liquidity pools" to institutional-grade financial infrastructure. That means teams need institutional-grade onchain compliance infrastructure. As our work with Plume shows, Predicate is ready to meet the challenge.

If you’re building an RWA project, Predicate can give you institutional-grade compliance. Contact us to learn more.